Spectacular Info About How To Deal With Credit Cards

Check if you have any priority debts before dealing with your credit card debt.

How to deal with credit cards. Credit card debt can seem like a black hole: Understand how much you owe. If you have multiple credit.

With high interest rates, the amount you owe can escalate quickly and finding a way out may seem impossible. The easiest way to get a better interest rate is applying for a 0% balance transfer credit card. 1 assess your credit card debt situation.

A workout arrangement is an agreed upon plan to renegotiate the terms of your credit card agreement. Once you have your data together, schedule time to call your credit card provider. While it may seem backwards, credit card companies are more likely to settle when the debts are large.

You might be able to get a better deal elsewhere. First, take a deep breath and remember: Keep the lines of communication open.

There are different options for credit card debt settlement. The first step is to assess your credit card debt. Capital one to purchase discover financial 00:16.

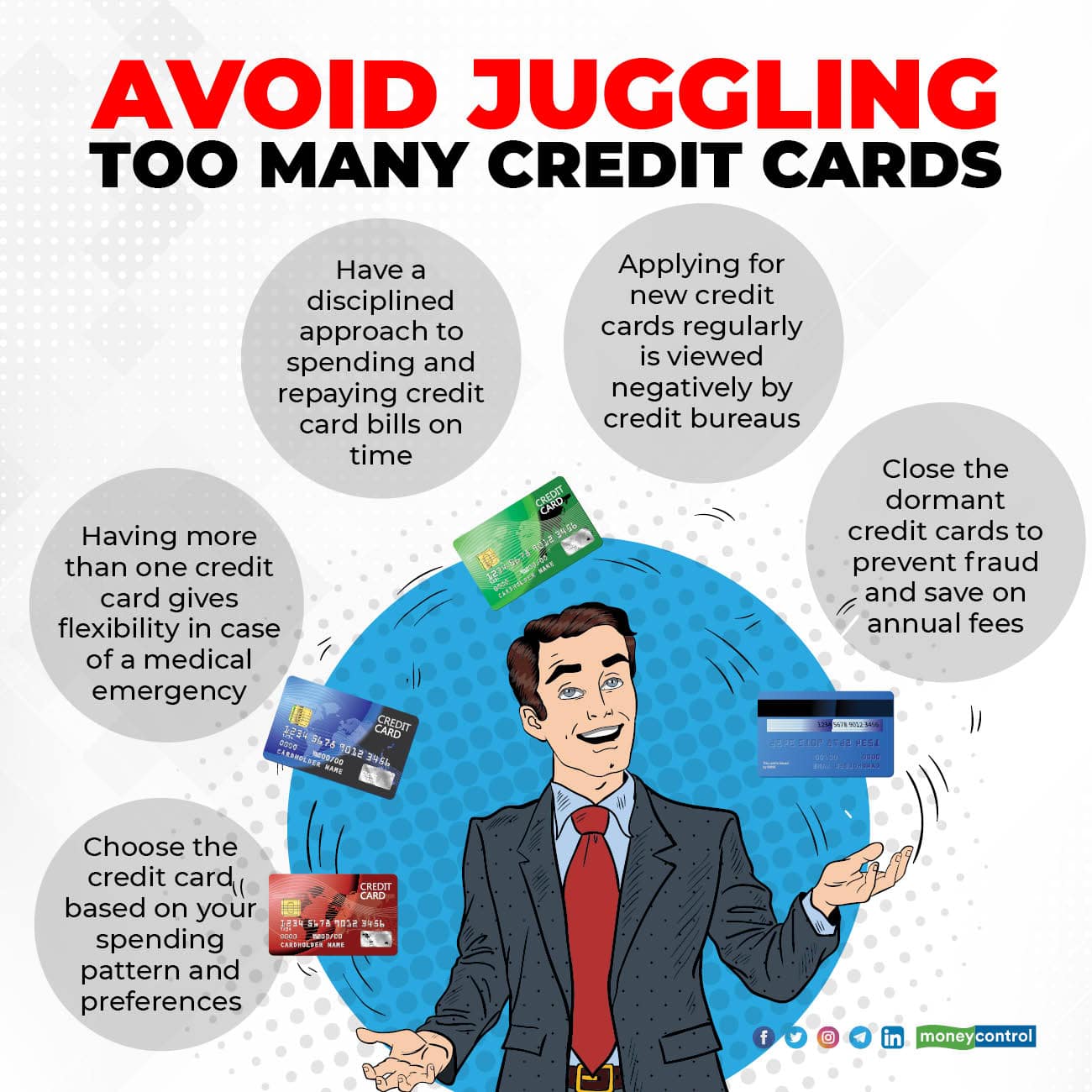

This will help you save interest in the future. Credit card debt is one of the most common financial struggles. If your credit is good but your debt payments feel overwhelming, consider consolidating.

If you contact your credit card company and ask for a better deal, the issuer may offer what is known as a workout arrangement. Before you pick up the phone, understand what settlement options are available and how. Try the snowball or avalanche method.

With a balance transfer, you'll shift your debt from one card to another one with a different. There are a number of ways you can pay off your credit card debt, including: The second option requires that you pay off the cards with the smaller balances to.

Consider these methods to help you pay off your credit card debt faster. When possible charge less or make more than the minimum payment. You can raise your credit score by paying down the balance on your credit cards.

The first one requires that you pay off the cards with the highest interest to get rid of them quicker. When you are done with the high interest ones, then you can work on increasing your payments on the other ones. What is the advantage for capital one of owning a credit card network?