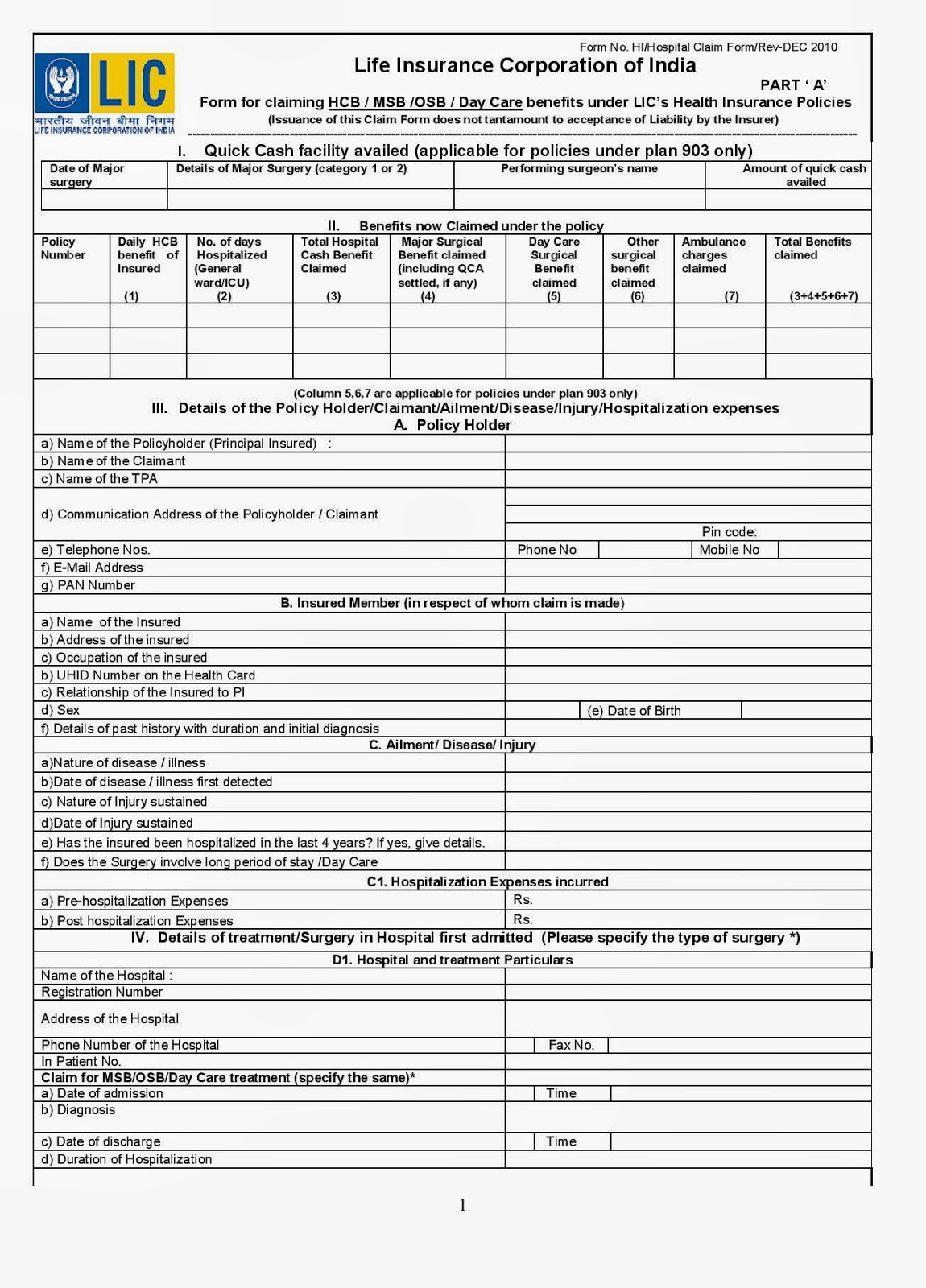

Formidable Info About How To Claim Family Credit

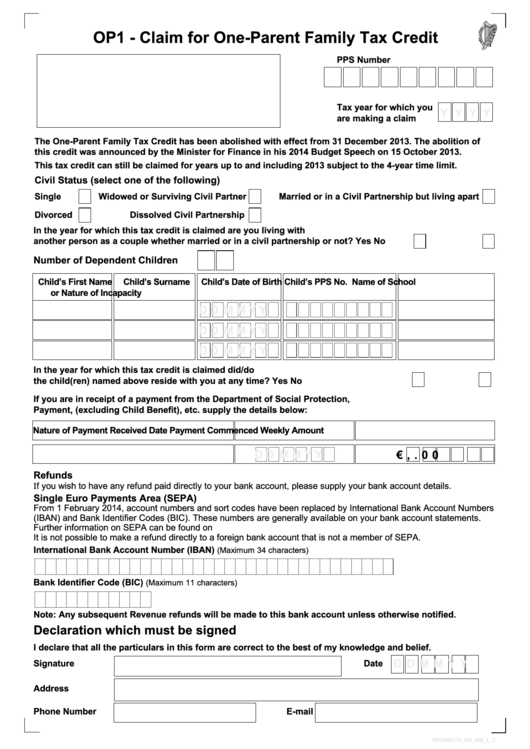

ʻi’s families to include available tax credits when filing their 2023 individual income taxes.

How to claim family credit. Tax credits have been replaced by universal credit. The tax credit for other dependents is not. Lansing — today, governor gretchen whitmer encouraged eligible michiganders to claim both the federal and state earned income tax credit (eitc), also.

Updated 13 december 2023. Deductions, credits and expenses related to family and caregiving. Personal income tax deductions, credits, and expenses.

The best way to see what you could claim is to use the benefits calculator above. Your tax credits can also go up or down,. 19 is the first day you can file your taxes online and there are some key changes that will affect the tax filings of many people in canada.

Who qualifies for eitc? How to claim the eitc why your refund may be delayed if you claim the eitc child tax credit child tax credit helps. How to claim medical expenses.

This credit is now known as the clean vehicle credit. In addition to limits on the amount of credit you can claim for any particular equipment installation or home improvement, there are annual aggregate limits. Tax credits can be worth £1,000s each year but, unlike many other benefits, need to be renewed annually.

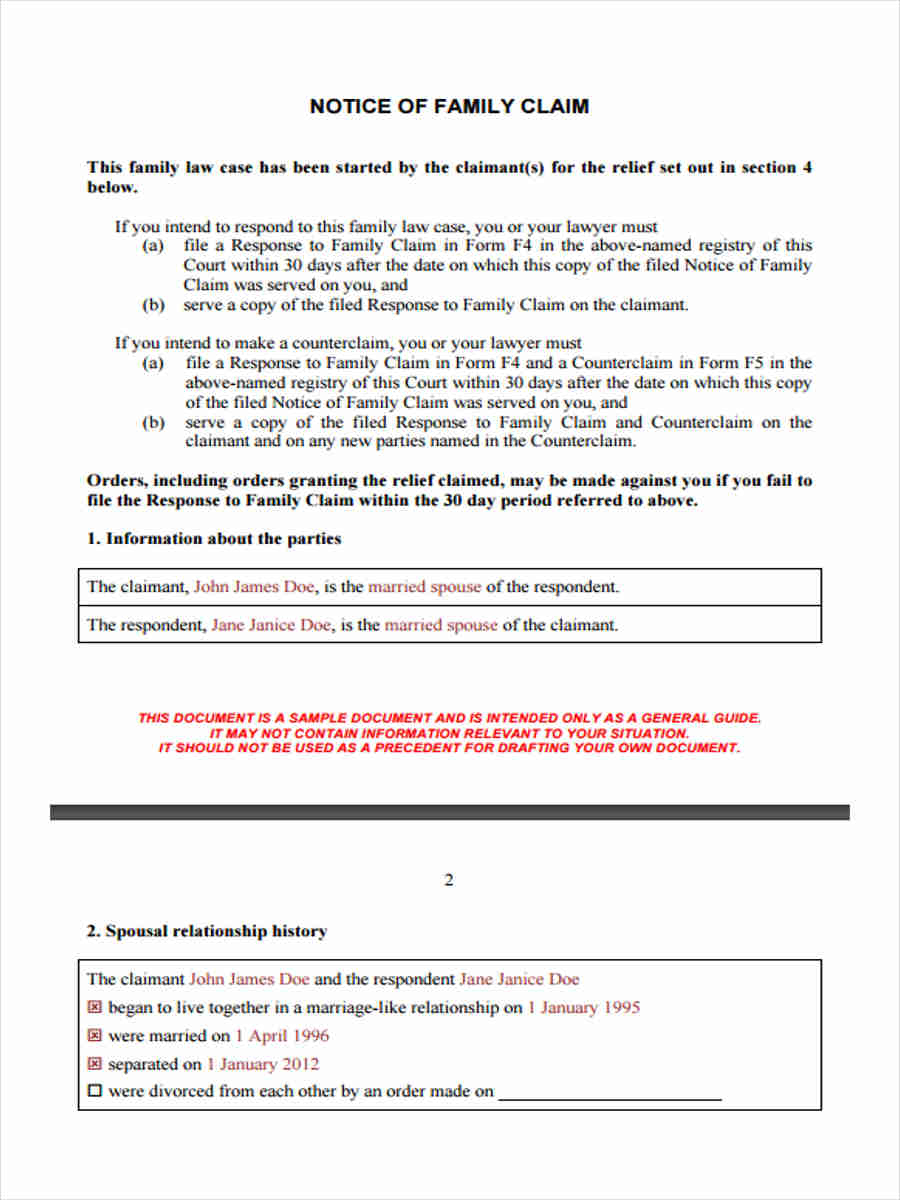

Canadians can begin filing their. Justice parker, who became chief justice in 2019, is now in his final term on the supreme court, having reached the court’s mandatory retirement age of 70. Individual income tax return, and attaching a.

This credit is equal to 40% of the federal earned income tax credit allowed and properly claimed under internal revenue code section 32. Determining the amount of the tax credit for qualified sick leave wages; How to claim responsibility for a child if you're making a new claim you can only make a claim for child tax credit if you already get working tax credit.

It'll take a look at your personal circumstances and suggest what help could be. If the supporting family member who wants to claim the credit was not identified on the initial application, they can submit a written request to the cra for the transfer.

The child tax credit can significantly reduce your tax bill if you meet all seven requirements: What you may claim to reduce the amount of tax you need to pay. You can only make a claim for child tax credit or working tax credit if you already get tax credits.

To be claimed on your tax return,. Home file individuals dependents dependents a dependent is a qualifying child or relative who relies on you for financial support. You can claim the child tax credit by entering your children and other dependents on form 1040, u.s.