Fun Info About How To Buy Cmbs

Method of purchase cash management bills can be purchased by individuals, fiduciaries, and corporate investors through a broker, dealer, or financial institution during the.

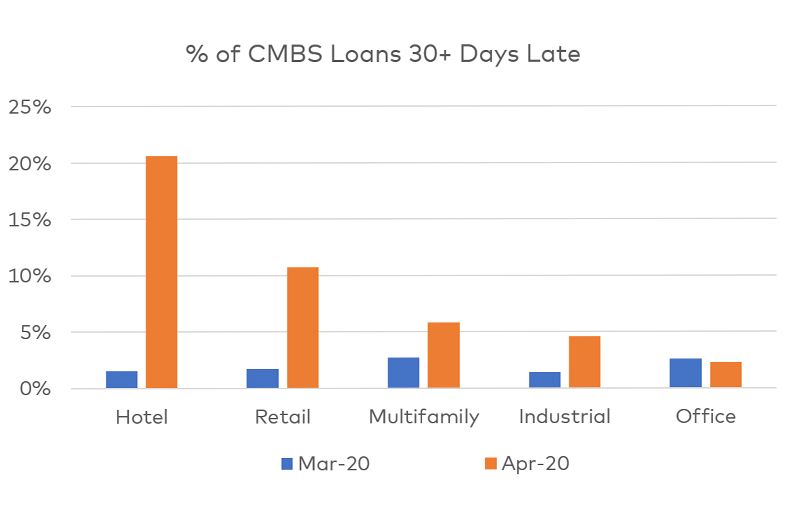

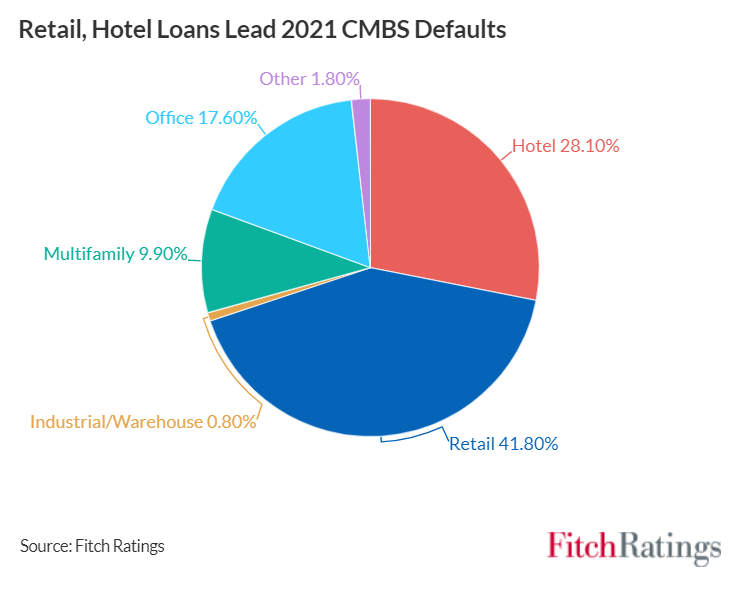

How to buy cmbs. These loans are for commercial properties. Cmbs loan delinquency rate will increase to 4.5% in 2024 and 4.9% in 2025, from 2.23% as of january 2024, assuming substantially more. The riskier, junior cmbs tranches offer the highest yields to investors, while.

Cmbx indices are a group of financial indexes that track the. If you would like to purchase a cmb, please contact a bank, broker, or dealer to place a bid on your behalf. Fortress has already acquired about $1.5 billion of performing office loans from financial institutions at prices ranging from 50 cents to 69 cents on the dollar, he said in.

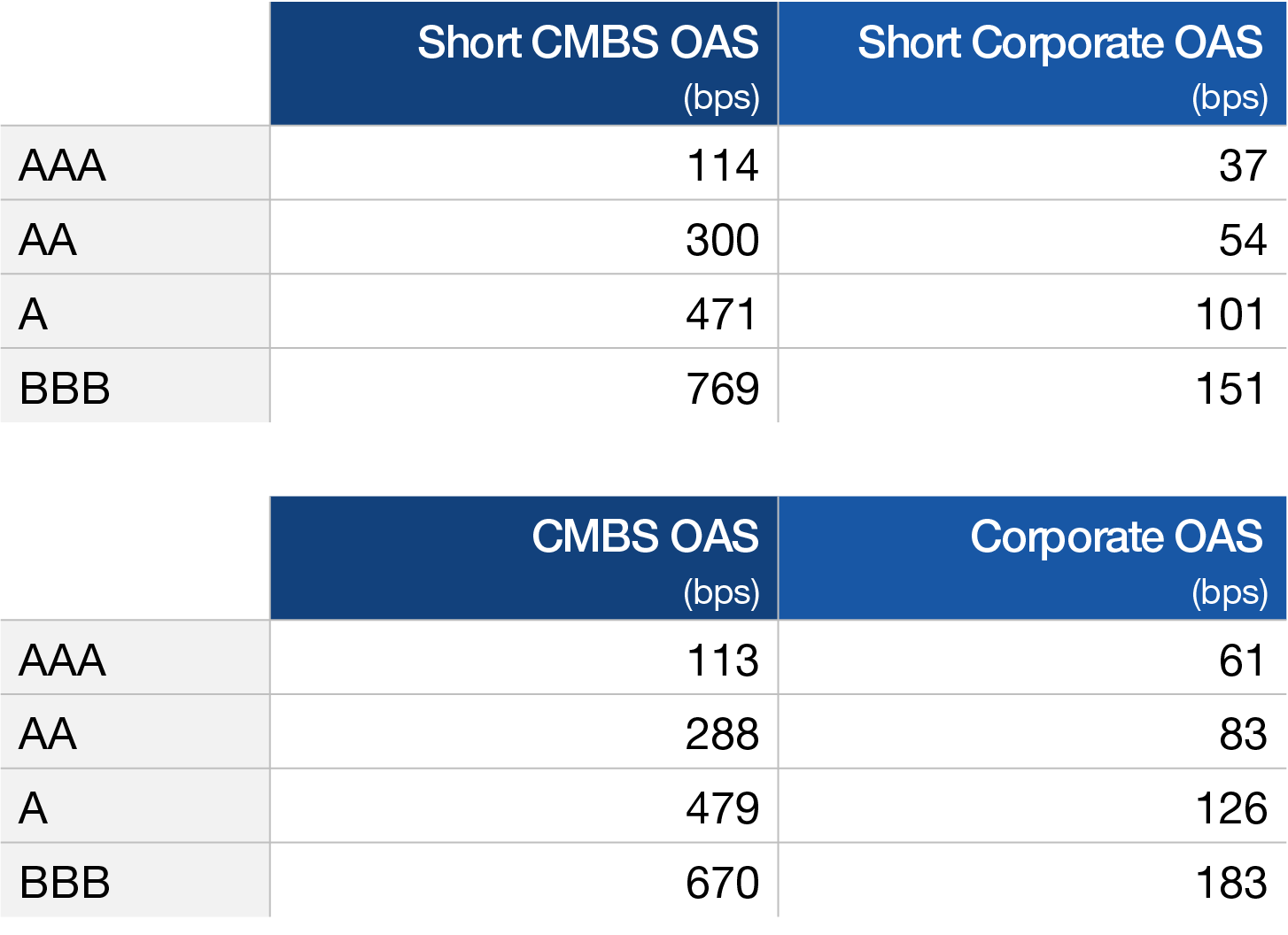

Effective march 23, 2020, the federal open market committee (fomc) directed the open market trading desk (the desk) at the federal reserve bank of new york to purchase. The exact purchase price couldn’t be ascertained, but barings’ bid cleared the more than $150. Cmbs is an asset class that institutional investors traditionally look to for yield enhancement and diversification to.

Click here to get quotes → $5.6m offered by a bank$1.2m offered by a bank $2m offered by an agency $1.4m offered by a credit union click here to get. Ishares cmbs etf. Get the real estate technical interview guide!

Download the pdf version of this insight. Fitch projects that its u.s. Therefore, one cmbs etf is publicly traded which is ishares cmbs.

As the cmbs finance is a new concept than reits which are publicly traded. Learn what cmbs loans are, how they work, and the advantages and disadvantages of taking one out. Find out how to apply for a cmbs loan, what types of.

Thus, making money by selling cmbs bonds in the market. Catalano what are cmbx indices? The cmbs lenders buy and sell, they buy in wholesale, and sell out in retail.

What types of investors buy cmbs bonds? Investing in cmbs unlike a sole local lender for a cre property, a cmbs investor has no direct contact with the borrower and is not an expert on every single one. Nav as of feb 21, 2024 $46.45.

It is backed by real estate loans. Various market participants buy cmbs.

![[Survey] Korean investors upbeat on infrastructure, aircraft leasing in](https://www.kedglobal.com/data/ked/image/2016/10/G4.jpg)